ATS Industrial Automation team members recently attended the Advanced Automotive Battery Conference (AABC) in Las Vegas. This year’s conference took place December 9-12, bringing together chief battery technologists from leading automotive original equipment manufacturer (OEMs) and key suppliers to discuss battery development trends and technical and business issues that will impact the pace and path of vehicle electrification around the world. Here are our top takeaways from the event.

One of the critical topics at AABC was the importance of reducing the cost of batteries. This effort is essential to make electric vehicles (EVs) more affordable and accessible to a broader market. The cost of battery packs has dropped significantly over the past decade, from around $1,100 per kilowatt-hour (kWh) in 2010 to approximately $137 per kWh in 2020. This reduction is crucial to achieve equal pricing between EVs and traditional internal combustion engine vehicles, which typically occurs when battery costs fall below $100 per kWh.

Despite these advancements, EV battery prices must fall to around $60 per kWh by 2030. Achieving this price point is crucial for making EVs more competitive with gas engine vehicles and to support the broader adoption of sustainable transportation options. Ongoing advancements in battery technology, the growing reliance on AI in design, testing, and manufacturing, and increased production capacity are key drivers in reaching this target, ultimately contributing to a greener, more efficient automotive industry.

Powering Up for an All-EV Future

At the conference, Kurt Kelty, vice president of battery cell & pack at General Motors, presented on the topic of “Driving Battery Development and Enabling an All-EV Future”. He highlighted General Motors’ strategic investments in battery technology and the robust supply chain established to support its growth over the next decade.

Kelty emphasized the importance of reducing battery costs and improving charging speeds to make EVs more competitive, noting that localizing manufacturing in North America is a critical step in achieving these goals.

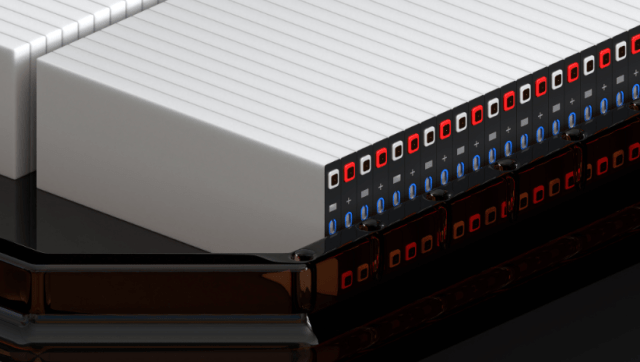

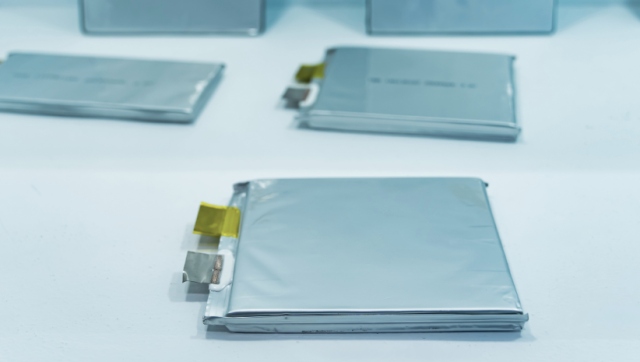

He also touched on the need to use different battery formats to optimize performance, safety, and cost-effectiveness based on the application. For instance, lithium iron phosphate (LFP) batteries are known for their safety, long cycle life, and thermal stability, making them ideal for electric buses and lower-cost EVs . On the other hand, lithium nickel manganese cobalt oxide (NMC) batteries offer higher energy density and are used in long-range EVs and targeted for premium vehicles. NMC batteries balance this with longevity and cost, so they’re a popular choice for passenger vehicles.

Emerging technologies like solid-state and lithium-sulfur batteries hold promise for greater advancements in safety and energy storage. Solid-state batteries offer higher energy density and improved safety compared to traditional lithium-ion batteries, so they’re suitable for high-performance EVs. Meanwhile, the abundant raw materials that make up sodium-ion batteries provide an inexpensive alternative. This is beneficial for applications where cost is a significant factor. Understanding these chemistries and formats—cylindrical, prismatic, and pouch cells—is crucial to fully grasp their impact on design, performance, and manufacturability. Each cell type offers unique benefits and challenges, and it’s important for manufacturers to select the right battery chemistry based on the vehicle applications they’re addressing.

Increasing EV Sales with Vehicle-to-Grid Enabled Battery Packs

Anil Paryani, executive engineering director of the advanced EV program at Ford, delivered an insightful presentation on the steps being taken to increase EV sales through vehicle-to-grid (V2G) battery packs. Paryani emphasized that rising electricity prices (compared to gasoline) and the underutilization of clean solar energy are key challenges that EV battery players and government entities need to address. By leveraging V2G technology, EVs can be charged using excess solar power and support the grid during peak demand times. It may also help reduce overall electricity costs, creating a cleaner, more efficient energy ecosystem.

Paryani noted that the biggest barriers to this approach are government policies and battery cycle life , which currently hinder the widespread rollout of V2G. To overcome these obstacles, local and state municipalities must implement necessary changes in electricity pricing, while manufacturers enhance battery cycle life to support the growth of EV sales. This approach not only promotes the usage of EVs but also contributes to a sustainable energy grid.

Recycling in Each Step of Battery Manufacturing

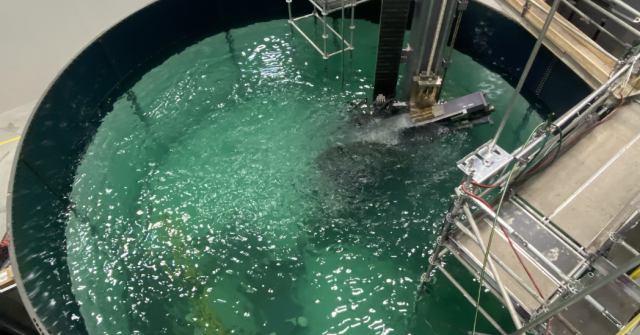

Colin Campbell, chief technology officer of Redwood Materials, spoke on the importance of “Building a Sustainable Battery Supply Chain” at the Advanced Automotive Battery Conference. He underscored the critical need to integrate recycling within battery manufacturing to reduce environmental impact, costs, and supply chain risks commonly associated with lithium-ion batteries. By incorporating recycling into the production cycle, manufacturers can recover and reuse materials almost infinitely.

The current supply chain for lithium-ion technology involves extensively transporting raw materials, often covering 50,000 miles before any processing occurs. This not only increases the carbon footprint but also adds to the overall cost and complexity of battery production. Establishing local recycling plants in the countries where vehicles are manufactured can significantly minimize this impact. This approach also ensures materials are efficiently reused, reducing the dependency on new raw materials. By focusing on recycling within the manufacturing process, the industry can champion the sustainable production of future lithium-ion batteries and support a more environmentally-friendly automotive industry.

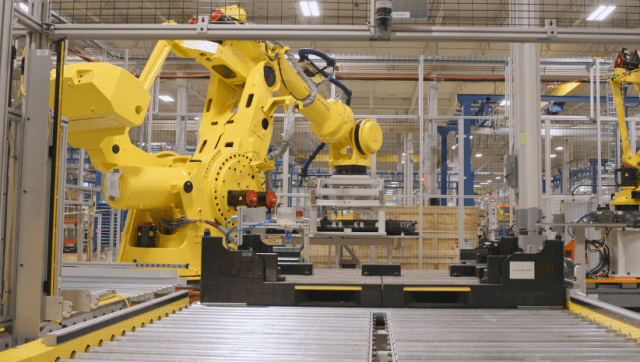

Expanding Battery Production in North America

Robert Lee, corporate executive vice president and head of North America at LG Energy Solution, delivered an impactful discussion on “Leading the Battery Expansion in North America” at the Advanced Automotive Battery Conference. Lee emphasized the unprecedented levels of investment being made to support EVs by North American OEMs and battery manufacturers.

Lee also discussed challenges ahead, including the need for a robust domestic supply chain to reduce dependency on foreign materials and using sustainable battery manufacturing practices. By focusing on localizing production and investing in advanced technologies, energy players can lead the way in creating a more resilient battery supply chain in North America.

Lee emphasized that the entire EV battery industry needs to focus on driving the cost of the entire value chain down. Without subsidies, the EV industry will need to stand on its own legs, and the only way to do that is to lower the cost of EV batteries as much as possible.

AI & Battery Manufacturing

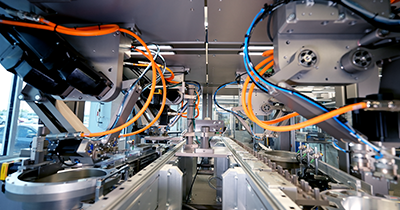

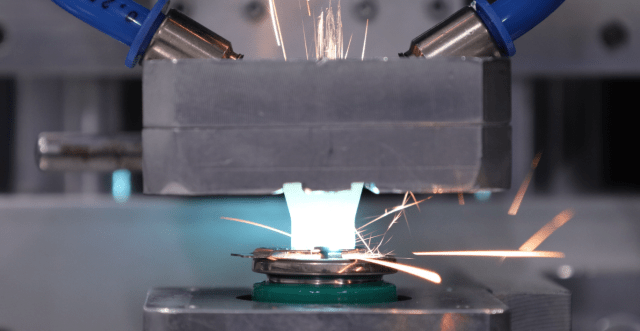

The use of artificial intelligence (AI) was another major topic at the conference, including how it revolutionizes battery manufacturing by optimizing processes, enhancing quality control, and reducing expenses. AI-driven solutions enable manufacturers to scale production efficiently while maintaining high quality standards. Key use cases of AI in battery development and manufacturing include:

- Development of Chemistry Configurations: Teams can use AI in experiments to gather data on battery chemistry. Traditionally, hundreds or thousands are required, but AI can analyze fewer trials to provide data more efficiently.

- Modeling of Manufacturing Processes: AI models take data and samples from the cells being produced and make real-time adjustments to the manufacturing process. This self-modulating, self-correcting, and self-learning approach improves productivity and quality.

- Battery Management Systems: AI manages the information from different cells, such as voltage, to control the outputs from each cell. This ensures the highest level of performance and prevents excessive heat, thereby extending the life of the battery pack.

As global manufacturers work to meet the growing demand for EV batteries and renewable energy, these AI applications are crucial to support the production of high-quality batteries at scale.

How United States Administration Changes May Affect the EV Market

Changes in the U.S. administration can significantly impact the EV landscape, particularly through adjustments to subsidies and regulatory policies. The upcoming transition to a new administration has revealed plans to slash electric vehicle incentives and funding, which could slow the growth of the EV market in the U.S. For instance, the incoming administration has proposed eliminating the $7,500 federal tax credit for electric vehicles and cutting funding for EV production and charging stations. These changes may make EVs less affordable for consumers.

Additionally, the new administration aims to roll back emissions rules and prioritize battery material production with new tariffs. This shift in policy could impact the overall cost structure of EV manufacturing and the competitiveness of U.S. made vehicles in the global market. By redirecting funds from EV incentives to national defense priorities—including securing China-free supplies of batteries and critical minerals—the administration’s approach marks a stark departure from previous policies that supported rapid EV transition. The changes underscore the importance of having stable and supportive government policies to foster the growth of electric vehicles, no matter who’s in office.

Battery manufacturers are concerned that these policy changes could disrupt the supply chain and increase production expenses, making it more difficult to achieve the necessary cost reductions to drive widespread EV adoption. These concerns necessitate the reduction of battery manufacturing costs throughout the supply chain.

The Outlook of the Battery Industry

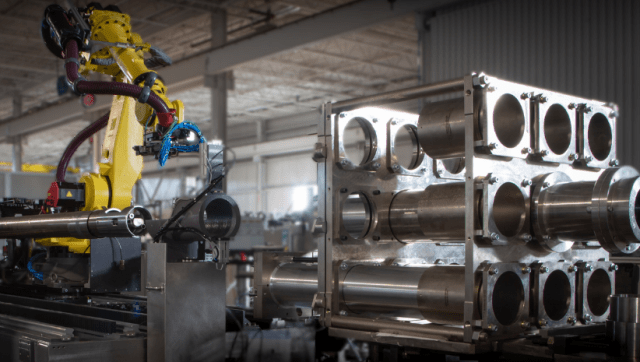

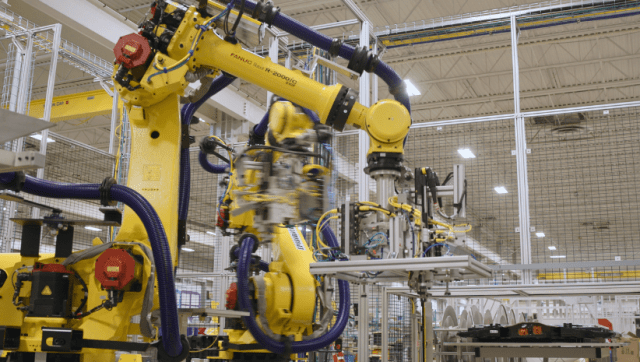

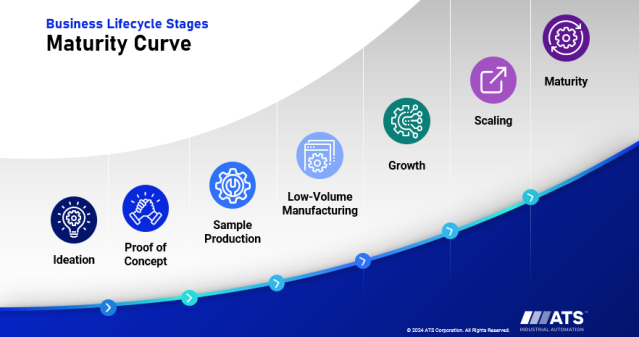

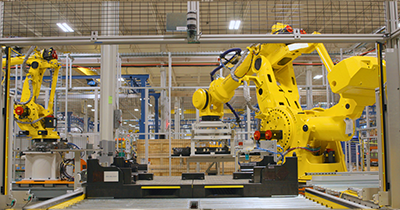

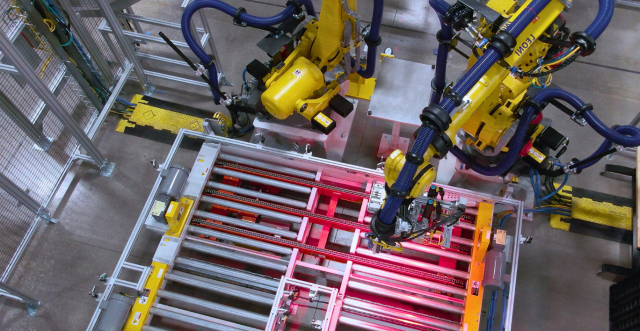

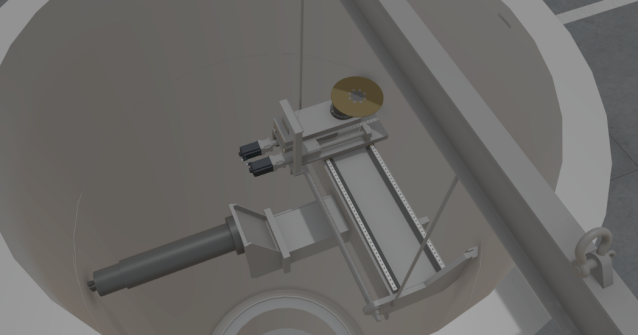

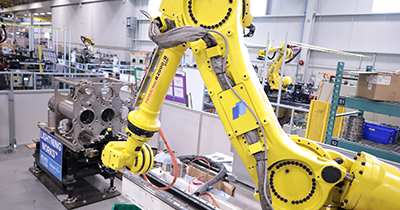

The future of EV battery manufacturing holds incredible promise but has some major hurdles to overcome—driven by an increasing demand for energy storage solutions and the global shift toward electrification. The industry faces several challenges that must be addressed to sustain this growth. While EVs and other battery-fueled technologies are here to stay, widespread support for their adoption—from sales to creating policies that prioritize green energy—remains at the intersection of opportunity. Battery manufacturers must secure a steady supply of raw materials and equipment, channel investments to bring down production and consumer costs, and efficiently execute large-scale industrialization. And when supported by automation technologies, companies can confidently bring their products to a larger market at a more competitive cost.

Additionally, manufacturers must commit to extensive, effective decarbonization to avoid greenwashing and differentiate themselves from the competition. The future of the EV battery industry hinges on its ability to become resilient and circular, ensuring a robust supply chain while meeting global demand. By emphasizing sustainability, battery leaders can generate value while helping to build sustainable societies for generations to come.

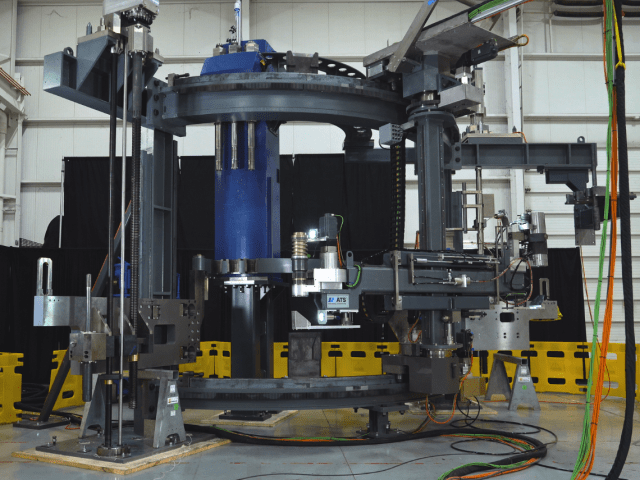

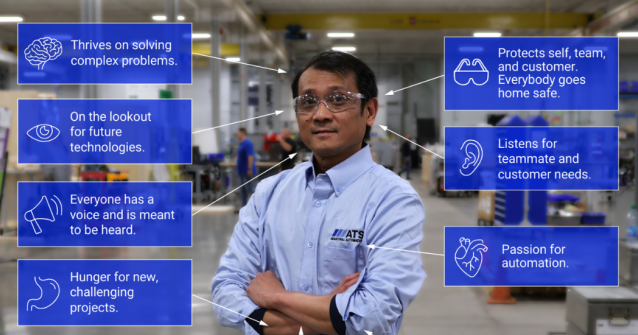

Every project is unique. Allow us to listen to your challenges and share how automation can launch your project on time.

Joe Brown

Business Development Specialist

ATS Industrial Automation

Joe helps companies of all kinds to automate and scale production using bespoke automated assembly, test, and conveyance systems.